You can be sued for damages caused by your car.

You can be sued for damages caused by your car. If a person or entity is injured in an accident, they will file a lawsuit against the driver of the vehicle that caused the accident.

This means that if you don’t have insurance and get into an accident, you could lose your vehicle if not paying for it (and any other assets) out of pocket can’t cover everything.

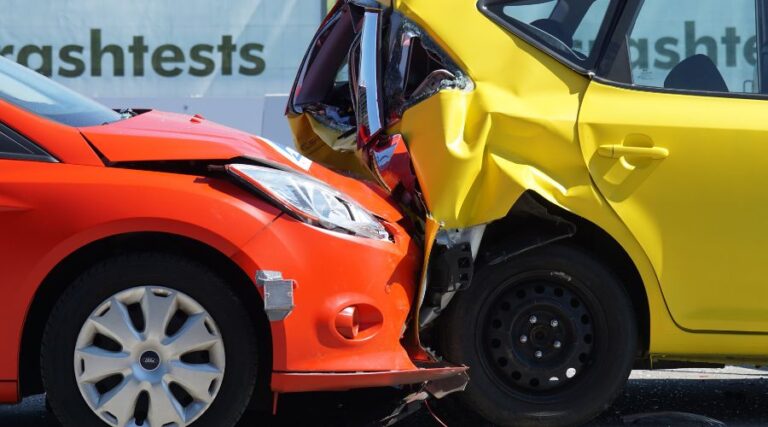

A car accident can happen anytime and anywhere.

A car accident can happen anytime and anywhere. You might be driving your car without insurance at that moment and get into an accident with another vehicle, or you may have an accident while riding your bike or even walking in the street. If you are involved in a car crash, then it is important that you ensure that your insurance covers all damages caused by their vehicle.

If there are injuries inflicted upon anyone involved in the accident, then they will be entitled to seek compensation from the other driver(s). The law states that if someone injures another person while driving recklessly or while being intoxicated on alcohol/drugs etc., then they could face penalties like fines as well as losing their license for up to one year depending on how much harm was caused during these incidents!

There are many costs involved in purchasing a vehicle.

The cost of a vehicle is also one of the most important factors to consider when buying a new one. The price can vary depending on the make, model and age of the vehicle you are looking at. You will also need to factor in insurance costs as well as maintenance costs when purchasing your next car or truck.

The average cost for a new vehicle is around $30,000 but some people may spend more than that if they want something luxurious like an SUV or luxury sports car with all its bells and whistles (e.g., leather seats).

Vehicle insurance is your insurance policy while you drive and own the vehicle.

Vehicle insurance is your insurance policy while you drive and own the vehicle. It covers you for damages caused by your car, other people’s cars, and even damage to other people’s property.

It also covers injuries to others when they are in an accident with your vehicle.

Driving without insurance is illegal but with it, it’s just fine

Driving without insurance is illegal and can result in a fine of up to $2,000. If you are found guilty of driving without insurance, your driver’s license will also be suspended. If caught by the police while driving with no coverage, they may impound your vehicle until you pay off any outstanding fines or repairs done to the vehicle; this is called “impounding” or “quarantine.”

Insurance protects you from financial loss caused by accidents or damages done by others while they are using your car (e.g., someone running into it). In case something happens and it results in injuries or death – even if they weren’t at fault – then that person might sue for compensation from their own insurance company as well as from yours too!

Conclusion

To avoid being a victim of an accident, you must have a valid driver’s license and vehicle insurance. If you don’t have it, then someone else will be at fault if something happens to your vehicle.

Now that you know why it’s so important to have car insurance, we hope this article has given you some useful information on how much coverage should cost per month in order to properly protect yourself against any possible liabilities incurred while driving around town with no coverage whatsoever