According to the CEO of blockchain firm Ripple, this year will see the total market capitalization of cryptocurrencies surpass $5 trillion.

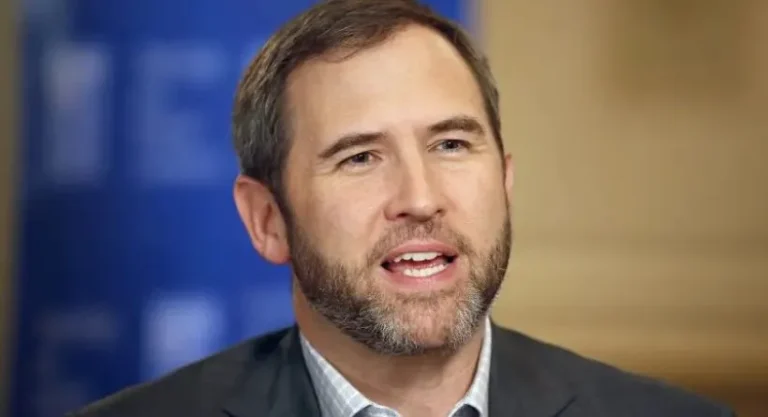

In an interview, Brad Garlinghouse of Ripple stated that he anticipates the value of the whole cryptocurrency market to double, citing several macro variables such as the forthcoming “halving” of bitcoin and the introduction of the first spot exchange-traded fund for bitcoin in the United States.

Garlinghouse said, “I’ve been in this business for a long time, and I’ve seen these trends come and go.” “I have a lot of optimism. I believe that for the first time, true institutional money is being driven by macro trends and big-picture items like exchange-traded funds (ETFs).

Garlinghouse observed, “You’re seeing that drives demand, and at the same time demand is increasing, supply is decreasing.” “You don’t need to be an economics major to understand what happens when supply declines and demand increases.”

The U.S. Securities and Exchange Commission authorized the nation’s first bitcoin exchange-traded funds (ETFs) on January 10. They let institutions and individual investors acquire exposure to Bitcoin without actually holding the underlying asset by trading on U.S. stock markets.

In the history of Bitcoin, half of the currency occurs about every four years. Bitcoin miners, who are volunteers on the network who utilize powerful computers to validate transactions and mint new coins, receive a mining incentive that is cut in half.

The next one is scheduled for later this month; the previous one happened in 2020.

“The total market capitalization of the cryptocurrency sector will likely quadruple by the year’s end due to the influence of these significant external factors,” stated Garlinghouse.

As of April 4, the whole cryptocurrency market was valued at over $2.6 trillion. A doubling of the market would suggest a $5.2 trillion overall market capitalization for cryptocurrencies.

Over 140% more has been added to Bitcoin in the past 12 months.

Data from CoinGecko indicates that on March 13, it reached a record high above $73,000. But since then, it has significantly dropped below the $70,000 mark.

The primary token propelling advances for the whole market has been the world’s digital currency.

With a market valuation of $1.3 trillion as of April 1, Bitcoin makes up around 49% of the whole cryptocurrency market.

Positive signs on U.S. crypto regulation

The potential for favorable regulatory movement in the US is one of the main variables that Garlinghouse believes will propel the cryptocurrency market to all-time highs.

Since this year is an election year, proponents of the cryptocurrency space are confident that the incoming administration’s policy priorities would be more receptive to the sector.

Under Chair Gary Gensler, the SEC has been vigorously enforcing its regulations against cryptocurrency businesses, including Ripple.

Alleging that Ripple illegally marketed XRP, a cryptocurrency with which it is intimately affiliated, in unregistered securities dealings, the SEC filed a securities case against the company. Ripple is contesting the lawsuit and disputes the allegations.

“I believe there will be greater clarity in the United States regarding the macro tailwinds for the industry,” stated Garlinghouse.

Despite being the greatest economy in the world, the U.S. cryptocurrency sector has, regrettably, been among the most antagonistic. And I believe that will also begin to alter.

Other cryptocurrency bulls besides Garlinghouse anticipate huge returns for the sector this year.

At a crypto conference in London, Marshall Beard, the chief operating officer of the American cryptocurrency exchange Gemini, recently said that he anticipates the price of bitcoin will reach $150,000 later this year.

“This year has gone by so quickly; there’s a lot of activity, a lot of adoption, new regulations, ETFs, the halving, miners needing to get out,” Beard said in an interview.

Beard said, “Until that new all-time high, which I think will be $150,000, you’re going to see violent moves up and down.” “It most likely occurs this year. It moves so swiftly, in my opinion, and I believe that the momentum and supply shock cause it to go quickly.

ALSO READ: